How to find Expected Value? Formula & Example

Table of Contents

How to find the expected value? An expected value is a statistic that is used to calculate the average value of a given probability distribution. The expected value is calculated by multiplying each possible outcome by its associated probability and then adding all of those products together. This calculation gives you the mean or average value that you can expect to occur if you were to repeatedly roll the dice, flip a coin, or take any other random action.

While the expected value is theoretical, it can be a very useful tool for real-world decision-making. For example, if you are considering investing in a new business venture, you can use the expected value to help you decide whether or not the investment is worth your time and money. You can also use it to determine how much you should bet on a particular gamble.

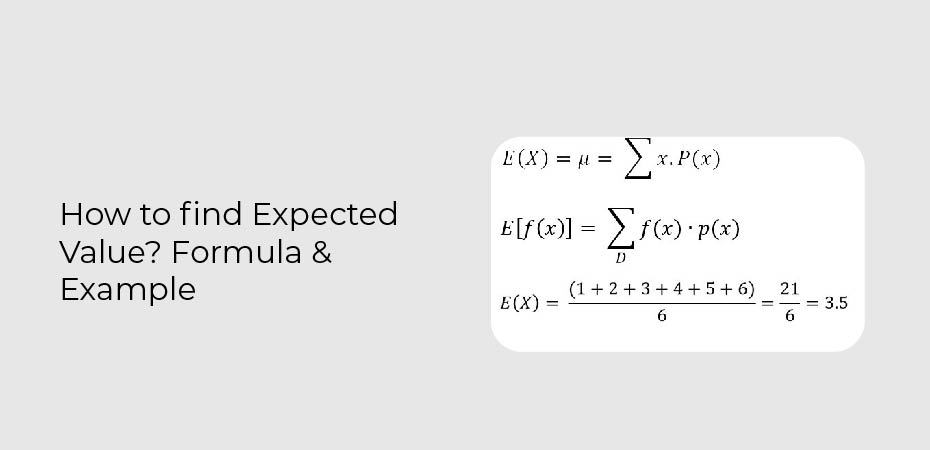

The formula for Expected Value

Expected value is a mathematical formula used to calculate the average return of an investment. The formula takes into account the probability of each potential outcome and the amount of money that could be won or lost depending on the outcome. This information is plugged into a formula that calculates the average return on investment for a particular gamble.

In such a case, the EV can be found using the following formula:

EV = P(X) × n

Where:

- EV – the expected value

- P(X) – the probability of the event

- n – the number of the repeats of the event

Example of Expected Value

Expected value is a mathematical term that is used to calculate the average of all possible outcomes of an event. In essence, it allows you to calculate how much you can expect to win or lose from a particular gamble. The calculation takes into account both the probability of each outcome and the associated payoff.

For example, let’s say you are offered a coin flip where you can win $10 if it comes up heads or lose $5 if it comes up tails. The expected value of this gamble would be calculated as follows:

($10 x 50%) + ($-5 x 50%) = 0

This means that on average, you would expect to break even from this gamble. However, there is always the chance that you could lose more or win more than the expected value depending on the outcome of the coin flip.

What Is a Dividend Stock’s Expected Value?

Dividend stocks are a great way to generate income and build wealth over time. But what is the expected value of a dividend stock?

Expected value is a measure of how much a particular investment is expected to return on average. It takes into account the probability of different outcomes and calculates the average of all possible outcomes.

When it comes to dividend stocks, there are a few things you need to consider when calculating expected value:

- The current yield – This is the percentage of the stock’s price that is paid out as dividends each year.

2. The growth rate – This is how much the company’s dividends are expected to grow each year.

3. The payout ratio – This is the percentage of profits that the company pays out as dividends.

How Is the Expected Value of a Stock Used in Portfolio Theory?

Expected value is a statistic used in probability theory to calculate the average value of a given function. In finance, the expected value is used to calculate the average return of an investment over time. This calculation is important for portfolio theory, which seeks to find the best mix of assets to achieve the desired level of risk and return.

The expected value of a stock is particularly important because it accounts for the fact that some stocks will outperform others over time. By taking into account both positive and negative outcomes, the expected value provides a more accurate estimate of a stock’s average return.

How Do I See the Expected Value of a Stock that Doesn’t Pay Dividends?

Finding the expected value of a stock that doesn’t pay dividends can be tricky. You have to take into account the potential for future dividends, and then calculate the present value of those dividends. To do this, you’ll need to know the company’s dividend payout ratio and its estimated growth rate.

First, determine the company’s expected dividend payout ratio. This is the percentage of earnings that the company plans to pay out as dividends. Next, determine the company’s estimated growth rate. This is how much the company’s earnings are expected to grow each year.

Now, you can calculate the present value of those future dividends. To do this, you’ll need to know how long you plan to hold onto the stock. You can use a financial calculator or a spreadsheet to do this calculation. Just enter in the numbers and hit “calculate.