Are you confused about which accounts are not temporary? Look no further! In this article, we will break down the key accounts that you need to know.

From assets to equity, we will cover it all. Say goodbye to temporary accounts and hello to a clearer understanding of your finances.

So, grab a cup of coffee and get ready to dive into the world of long-term accounts.

Assets

You should review your assets regularly to ensure they’re properly managed. Your assets are the valuable resources that you own, such as property, investments, and personal belongings.

By regularly reviewing your assets, you can keep track of their value and make informed decisions about how to best manage them. This includes evaluating their performance, assessing any risks or liabilities associated with them, and considering potential opportunities for growth.

Regular reviews also help you identify any changes in your financial situation that may require adjustments in how you manage your assets. Additionally, by staying updated on the value and condition of your assets, you can make more informed decisions about insurance coverage and estate planning.

Taking the time to review your assets regularly ensures that you’re maximizing their potential and protecting your financial well-being.

Liabilities

Liabilities are the unpaid debts and financial obligations that you have. They represent the amount of money that you owe to others.

It’s important to understand that liabilities can be short-term or long-term, with long-term liabilities being financial obligations that you have to fulfill over a longer period of time.

Unpaid Debts

Don’t ignore your unpaid debts. It’s important to address them head-on and take responsibility for your financial obligations. Ignoring your debts can lead to serious consequences, such as damage to your credit score, legal action, and even bankruptcy.

Take the time to assess your outstanding debts and create a plan to repay them. Consider contacting your creditors to discuss potential payment arrangements or debt consolidation options.

By taking proactive steps to address your unpaid debts, you can regain control of your financial situation and work towards a debt-free future. Remember, ignoring the problem will only make it worse.

Take action now and start working towards financial stability.

Financial Obligations

Make sure to prioritize your monthly bills and stay on top of your financial obligations.

It’s crucial to manage your finances wisely and ensure that you meet your financial responsibilities. By prioritizing your monthly bills, you can allocate your funds efficiently and avoid any potential financial pitfalls.

Start by identifying your essential bills, such as rent or mortgage, utilities, and insurance premiums. These are the expenses that need to be paid on time to maintain a stable living situation.

Next, consider your other financial obligations, such as loan payments, credit card bills, and subscriptions. Stay organized by setting reminders or using budgeting apps to help you keep track of due dates.

Long-Term Liabilities

You should regularly review and assess your long-term liabilities, as they can have a significant impact on your financial stability.

Long-term liabilities are debts or obligations that aren’t due within the next year. Examples include mortgage loans, car loans, and student loans.

By reviewing and assessing these liabilities, you can better understand your financial situation and make informed decisions about your future. It’s important to consider factors such as interest rates, repayment terms, and the overall impact on your monthly cash flow.

Regularly reviewing your long-term liabilities can help you identify any potential risks or opportunities for improvement. It’s also important to keep in mind that your long-term liabilities can affect your credit score and borrowing capacity, so it’s essential to manage them responsibly.

Take the time to review your long-term liabilities and make any necessary adjustments to ensure your financial stability.

Equity

Equity is the portion of a company’s value that belongs to the shareholders. It represents the residual interest in the assets of the company after deducting liabilities.

Understanding equity involves examining three important points:

- Contributed capital, which is the amount invested by shareholders.

- Retained earnings, which is the accumulation of net income over time.

- Dividends and distributions, which are payments made to shareholders.

Contributed Capital Explanation

Let’s dive into the explanation of contributed capital and how it impacts the overall equity of your business.

Contributed capital refers to the funds that investors or shareholders contribute to your business in exchange for ownership rights. It’s a crucial component of your company’s equity, representing the initial investment made by shareholders.

Contributed capital can come in various forms, such as cash, equipment, or property. When investors contribute capital, it increases the equity of your business and strengthens its financial position. This capital serves as a cushion to cover any potential losses or liabilities.

Additionally, contributed capital plays a vital role in attracting new investors and lenders, as it demonstrates the financial stability and commitment of your shareholders.

Retained Earnings Calculation

To calculate your company’s retained earnings, subtract the dividends paid out to shareholders from the net income earned.

Retained earnings represent the portion of a company’s profits that’s kept and reinvested back into the business. It’s an important financial metric that reflects the cumulative earnings of the company over time.

By subtracting the dividends paid out, you can determine how much of the net income has been retained within the company. Retained earnings can be used for various purposes such as funding future growth initiatives, investing in research and development, or paying off debt.

It’s a measure of financial stability and can provide insights into a company’s ability to generate profits and sustain its operations in the long term.

Dividends and Distributions

If you want to understand how dividends and distributions affect equity, you should consider their impact on the financial stability of your company.

Dividends are payments made by a company to its shareholders, usually in the form of cash or additional shares of stock.

Distributions, on the other hand, refer to the allocation of a company’s profits to its owners or investors.

Both dividends and distributions can have a significant impact on the equity of your company.

By paying out dividends or making distributions, you’re reducing the amount of retained earnings, which can affect the financial stability of your company.

It’s important to carefully consider the amount and timing of these payments to ensure that your company remains financially stable and able to meet its obligations.

Retained Earnings

You should understand that retained earnings are an important part of a company’s financial statement. Retained earnings represent the cumulative net income or profit of a company that isn’t distributed to shareholders as dividends. Instead, these earnings are reinvested back into the business for growth, expansion, or debt reduction.

Retained earnings can provide valuable insight into a company’s financial health and its ability to generate profits over time. They’re often seen as an indicator of a company’s stability and long-term success. By analyzing the trend of retained earnings over multiple periods, investors and stakeholders can assess the company’s profitability, management decisions, and future prospects.

It’s important for you, as an investor or business owner, to understand the significance of retained earnings and how they impact a company’s overall financial position.

Investments

But, as an investor, you should also consider diversifying your portfolio to minimize risk and maximize potential returns. Investing in a variety of assets can help protect your investments in case one sector or asset class underperforms.

By spreading your investments across different types of stocks, bonds, real estate, and even alternative investments like commodities or cryptocurrencies, you can reduce the impact of any one investment’s poor performance on your overall portfolio. Diversification allows you to take advantage of different market cycles and potentially increase your chances of finding winners in various industries.

It’s important to conduct thorough research and seek professional advice to ensure you’re making well-informed investment decisions. Remember, diversification is a key strategy for long-term investment success.

Long-Term Debt

By carefully managing your long-term debt and making timely payments, you can maintain a strong credit score and financial stability.

Long-term debt refers to any loans or financial obligations that aren’t expected to be paid off within a year. This includes mortgages, car loans, student loans, and personal loans.

It’s important to keep track of your long-term debt and make sure you’re making regular payments. Late or missed payments can negatively impact your credit score and make it more difficult to secure future loans or credit.

Conclusion

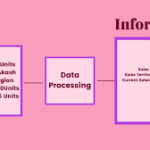

So, to sum it up, a temporary account isn’t a long-term financial commitment. It includes assets, liabilities, equity, retained earnings, investments, and long-term debt.

Temporary accounts are used to track transactions during a specific period, while permanent accounts contain information that carries over from one accounting period to another.

By understanding the distinction between temporary and permanent accounts, you can accurately analyze the financial standing of a company.